Canada Learning Bond

An RESP for your child... No matter your income!

If your child is eligible to the Canada Learning Bond (CLB), Kaleido offers you a no-charge, no-obligation registered education savings plan (RESP)! This plan is opened for the sole purpose of receiving this grant.1. Your child could receive up to $2,000 without you having to invest a single penny!2

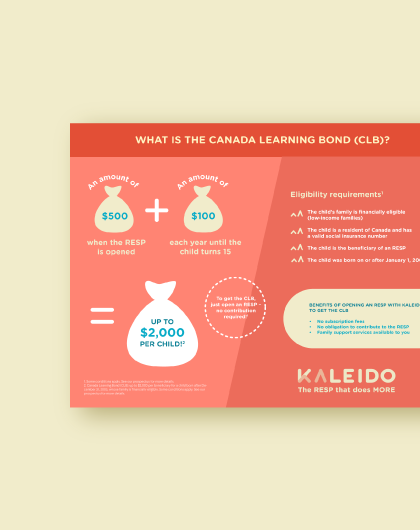

What is the CLB?

The Canada Learning Bond is money that the Government of Canada adds to an RESP for children from low-income families.

For your child to receive the CLB, you simply need to open an RESP for free, without any obligations to make contributions1.

- An initial $500 is paid at plan opening to help you save for post-secondary education.

- Your child could also receive an extra $100 each year until their 15th birthday, for a total of $2,0002.

To Be Eligible, Your Child Must:

Be born on or after January 1, 2004.

Be a resident of Canada.

Have a valid Social Insurance Number (SIN).

Be named in an RESP.

Be from a financially eligible family given its limited income (e.g. low wages, unemployment, large family, maternity leave, single parent, etc.).

Is my family financially eligible?

CLB eligibility is based on the adjusted family net income of the child’s primary caregiver (including the spouse’s income) and the number of eligible children in a family. Talk to one of our scholarship plan representatives to know if your family could be eligible.

Here are some case scenarios where families could be eligible for the CLB:

Demers Family

Juliet and Alexander are proud of their parents, self-employed workers who decided to live off their passion, even if it meant a lower income.

Gagnon Family

Julia is a single mom raising her two- and four-year-old sons with one income.

Lopez Family

Ana and Jordan recently settled in the province of Quebec with their three children. They are currently looking for a job.

Advantages of choosing an RESP with Kaleido to receive the CLB

- $0 sales charges

- $0 contributions required. However, you can always choose to add to your RESP later on! Your child will benefit from other RESP grants that boost your contributions by 30% to 60%3

- Personalized guidance from your representative

- All accumulated funds available upon school registration to post-secondary education, whether in a vocational, college or university program4

Fact sheet on the CLB

Download your fact sheet on the Canada Learning Bond and have all the useful information at your fingertips!

*Mandatory Field

Find out in seconds how much an RESP could earn you with the free calculator.

Find out if you are eligible to the CLB

1. Certain conditions apply; please see our prospectus.

2. For a child born after December 31, 2003, from a financially eligible family. CLB Eligibility is reviewed yearly.

3. Canada Education Savings Grant (CESG) from 20 to 40 % and Québec Education Savings Incentive (QESI, only in the province of Québec) from 10 to 20 %. Based on the adjusted family net income. The maximum annual amount poured in CESG is $600 and $300 in QESI. The lifelong maximum amount contributed per beneficiary is $7,200 in CESG and $3,600 in QESI. Certain conditions may apply. Refer to our prospectus.

4. Please see our prospectus for the complete list of eligible programs of study. Subject to standards established by Canada’s Income Tax Act. Some conditions apply.