How does the Registered Education

Savings Plan (RESP) work?

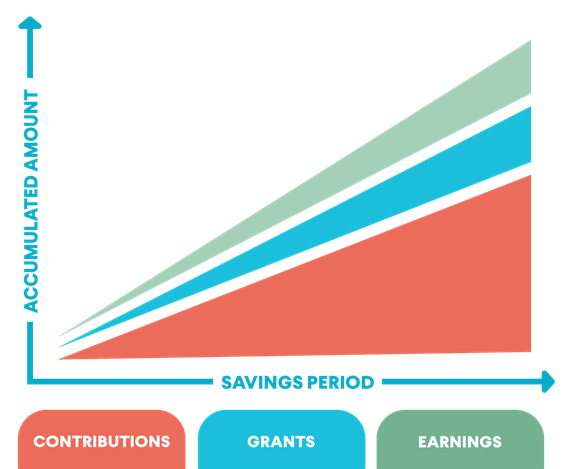

The RESP works simply and advantageously, thanks to your contributions and generous government grants. In fact, your contributions, big and small, grow quickly in a registered education savings plan.

*The ratios used are not representative of reality and are for information purposes only.

Grants and earnings are paid to the student to cover their school expenses. These are called educational assistance payments (EAPs).

Contributions invested are returned to the subscriber (the person who opened the RESP), who can give the money to the student or use it for something else.

How much could your RESP actually earn?

Get the results in a few seconds!

What is an RESP?

RESP stands for “registered education savings plan.” An RESP is designed to help you save for a child’s post-secondary education. It also allows you to achieve your financial goals more easily, as you’ll receive generous government grants on top of your contributions. Over time, your savings and the money invested by the government will grow tax-free. It’s simple to use and it pays off!

What are the RESP steps?

Birth of a child

Baby on the way or already here! You can start thinking about your child's future now by opening an RESP. All you need is the child's Social Insurance Number (SIN).

RESP opening

RESP opening

This is when you set up your education savings plan.

Our representatives know RESPs inside and out. They can help you choose the right plan for your family.

You can start making contributions as soon as your child is born. You’ll get the most out of your RESP by investing early.

And if your child is already hitting their teen years (it goes by so fast!), don’t worry! It’s never too late to open an RESP. You can make up for unused grants in previous years,2 so investing late still offers plenty of advantages.

Contact one of our representatives.

They will explain everything you need to know about RESPs and answer any questions you may have. They have the expertise to offer advice based on your needs, your investor profile, and your savings goals.

No, unfortunately that’s not possible.

The child (or beneficiary) must be a Canadian resident at the time the RESP is opened and while contributions are being made. This is a legal requirement under Canada’s Income Tax Act.

No, Kaleido takes care of everything! Once your RESP is open, Kaleido will apply for the grants on your behalf. Your representative will have you sign the required forms when you sign the contract.

Just be sure to send us your Social Insurance Number (SIN) and the SIN of your beneficiary via your Client Space. This is essential to receive the grants your child is entitled to and to keep your RESP active.

Yes.

The Canada Revenue Agency requires this information to register your RESP. You must provide the SINs within 24 months of signing your contract for your plan to remain effective.

But remember, the sooner we receive the SINs, the sooner you receive the grant money!

RESP contributions

RESP contributions

Have you chosen how long you want to save? 2 years? 5 years? 10 years, or more?

Do you prefer the peace of mind of preauthorized monthly contributions? Or perhaps annual payments3 are better suited to you?

Once you decide, you’re all set. Now it’s up to you to contribute!

It all depends on which type of RESP you open.

With our IDEO+ line of RESPs (Conservative, Adaptive, and Responsible), you decide how much to contribute and how often from among the options available. You can choose to make monthly or one-time contributions.3

To find out which product is best suited to your situation, talk to one of our representatives.

Yes, depending on the RESP you choose.

With our IDEO+ line of RESPs (Conservative, Adaptive, and Responsible), you can reduce or increase your contributions, change your monthly contribution schedule, or easily make a one-time contribution to meet your personal needs and goals. You are not required to make regular contributions.

If you would like to make changes to your contributions, contact us and we’ll help you find the best solution for you.

Yes, not to worry! At Kaleido, we know that life sometimes throws you a curve ball.

Whether you have chosen a Conservative, Adaptive, or Responsible IDEO+ RESP, you can temporarily suspend your payments while you make a new game plan.2

Once you get back on track, there are several options available to you to continue saving toward your goals. In any case, we’ll be able to offer a solution that’s best for you.

Returns and interest

Returns and interest

As your child grows, so does your RESP! Your contributions add up quickly and generate earnings of their own.

And don’t forget, you’ll receive government grants on top of your investment. Your child could receive up to $12,800 in grants!4

Good to know: returns, a key aspect of the RESP!

Obviously, one of the biggest advantages of opening an RESP is that you can earn returns. Your return is usually expressed as a percentage and corresponds to the increase (or sometimes decrease) in the value of your investment. For example, if you have $1,000 in your RESP and its value increases to $1,050 the next year, you have earned a 5% return. The secret to maximizing your return? Time! Your return for the following year will be calculated not on your original $1,000, but on the $1,050 you now have.

You can get an idea of your return based on the amount of your payments and how long you’ve been making them using the return calculator on the Autorité des marchés financiers (AMF) website (in French only). Add in government grants and you can see the appeal of an RESP!

No extra steps are required to start receiving government grants once you open an RESP. The money your child is entitled to is deposited directly into their RESP based on your contributions.

Want to get an idea of how much your child could receive? Try our RESP calculator!

Yes, it is!

Whether you have an RESP from the IDEO+ line (Conservative, Adaptive, or Responsible) or an older Kaleido plan, you can change your beneficiary until they are 21 years old, under certain conditions. See our prospectus for more details.

Contact us to learn more.

Post-secondary education on the horizon

Post-secondary education on the horizon

You’re almost to the finish line! Your child will be graduating from high school soon and starting to think about the future. It’s time to start planning ahead and making decisions!

You can soon apply for a refund of your savings. Requests for refunds of your contributions or Educational Assistance Payments (EAP) for your beneficiary are made via your Client Space.

Eligible post-secondary educational institutions include CEGEPs, universities, trade schools, colleges and other educational institutions accredited by the Employment and Social Development Canada Minister. For more information, consult the List of Designated Educational Institutions in Quebec and New Brunswick on the Government of Canada website.

As planned, you will receive a refund of your contributions at plan maturity,5 even if your child doesn’t pursue post-secondary education.

You can also choose one of the following options, under certain conditions6:

- Transfer the RESP to another child

- Transfer the accumulated income to an RRSP

- Cash in your accumulated income (through accumulated income payments)

Not at all! Our plans provide educational assistance payments (EAPs) for all levels of post-secondary education, including trade school programs.1

Yes, it is.

Our RESPs allow your beneficiary to pursue post-secondary education outside of Canada if they wish. EAPs will be issued based on the criteria set out in Canada’s Income Tax Act, subject to investment risks and applicable fees.

Payments for school

Payments for school

Your beneficiary is embarking on a new phase of life: post-secondary education1!

They can now start receiving educational assistance payments (EAPs), depending on the terms of your RESP. EAPs include the grant money in your plan as well as the income earned on both the grants and your savings.

The subscriber decides when to withdraw EAPs for a beneficiary pursuing an eligible program of study. They can also determine the amount, subject to legal limits. Payments can therefore be made according to the student’s needs.

See our prospectus for more information on calculating EAPs.

You can apply for educational assistance payments (EAPs) as soon as your child is enrolled in school. EAPs include the grant money in your plan as well as the income earned on both the grants and your contributions.

Yes. Educational assistance payments can be used to cover tuition and all other education-related expenses, such as housing, school supplies, computer equipment, food, transportation, car expenses, and more.

Refund of contributions

Refund of contributions

Time to reap the rewards!

Now that your contract has reached maturity, you can access all (or a portion) of the contributions you’ve made over the years.5

You can use this money however you see fit, without paying tax on it.

Remember that to ensure your beneficiary can receive the grant money accumulated for them, you need to provide the government with proof of enrolment in an eligible post-secondary program.1

Your plan’s maturity date is set when you sign your contract.

Plans mature in the year the beneficiary turns 17, which is usually the year they’ll begin their post-secondary education.

The government grants, their income, and the income earned on your savings will make up the educational assistance payments (EAPs) the student will receive.

The balance, which corresponds to the value of the contributions made throughout the savings period, comes back to you at maturity, subject to investment risks and applicable fees.2 You can then choose to pass on this amount to the student or use it as you see fit. Remember that this refund is tax-free!

At this stage, the government requires proof of enrolment in a post-secondary program in order to keep the grant money accumulated for your beneficiary.

If your child is not yet enrolled in a post-secondary program, you have two options:

- Wait until they are enrolled before applying for a refund of your contributions. This will ensure the grant money stays in your plan for future educational assistance payments.

- Request a refund of your contributions. Important note: In this case, the grant money will be returned to the government!

In both cases, your beneficiary is still entitled to their EAPs. (If you choose the second option, the EAPs will only include the earnings on your contributions.) They can claim them until the plan expires.

An RESP expires on the last day of the 35th year following the year the plan took effect.

Looking to understand the basics of RESPs?

Check out our ”RESPs” 101 e-Book: a step-by-step tool to help you navigate the most beneficial options.

Learn more

Interested in reaping the benefits of an RESP?

Talk to one of our education savings professionals!

1. For the complete list of eligible post-secondary programs, see our prospectus at kaleido.ca.

2. Certain conditions apply. See our prospectus at kaleido.ca.

3. Subject to the minimum amounts required for the first contribution and subsequent deposits. See contribution options in our prospectus at kaleido.ca.

4. Canada Education Savings Grant (CESG) of 20% to 40% and Quebec Education Savings Incentive (QESI) of 10% to 20%. Based on adjusted family net income. The annual limit is $600 for the CESG and $300 for the QESI. The lifetime limit per beneficiary is $7,200 for the CESG and $3,600 for the QESI. Canada Learning Bond (CLB) of up to $2,000 per beneficiary, for children born to financially eligible families after December 31, 2003. Certain conditions apply. See our prospectus at kaleido.ca.

5. Savings invested in treasury bills, government bonds, and high-quality companies. Refund of contributions is subject to investment risk. Certain conditions apply. See our prospectus at kaleido.ca.

6. For full details on these options, see our prospectus at kaleido.ca.