Which investment is more advantageous,

an RESP or an RRSP?

First of all, it’s important to understand that RESPs and RRSPs are two important savings tools. So you don’t necessarily have to choose between them; in fact, many people use a combination of the two. RESPs (Registered Education Savings Plans) and RRSPs (Registered Retirement Savings Plans) both offer significant advantages and fulfill very distinct roles.

Want to take advantage of the RESP? Let’s talk about it!

Which is better, an RESP or an RRSP? If you’ve ever wondered about your long-term investments, watch the video below to learn more about the benefits of RESPs.

It’s important to remember the tax advantages and the functions of RESPs and RRSPs. Let’s look at the definition of each term.

RRSP – Registered Retirement Savings Plan

As its name suggests, an RRSP is a savings vehicle for retirement. It offers a number of tax advantages, which you can find out more about on the Autorité des marchés financiers website.

This plan reduces your taxable income for the year of investment and can be used to purchase a first home through the HBP (Home Buyers' Plan).

The maximum RRSP contribution is 18% of your previous year’s income, up to a maximum of $32,490 for 2025. If you have not contributed the maximum amount in previous years, you can add this unused contribution room to your maximum amount.

RESP – Registered Education Savings Plan

This option is a savings vehicle for your children’s post-secondary education. The main advantage of an RESP lies in the generous government grants: up to a lifetime maximum of $12,800 per child.1 The maximum you can contribute to obtain maximum grants is $2,500 per year.

If you haven’t contributed in certain years, or if you haven’t reached the maximum possible, you can use your unused grant entitlements from previous years, up to a maximum of $5,000 per year.2 There is no annual contribution limit to the RESP. However, the lifetime contribution limit is $50,000 per child.

In this way, you will have access to two cumulative RESP benefits that your children can enjoy during their post-secondary studies.3 They will then be able to benefit not only from generous government grants,4 but also from the accumulated earnings on contributions and grants, in the form of Educational Assistance Payments (EAP). A great financial boost to help with the many costs associated with education!

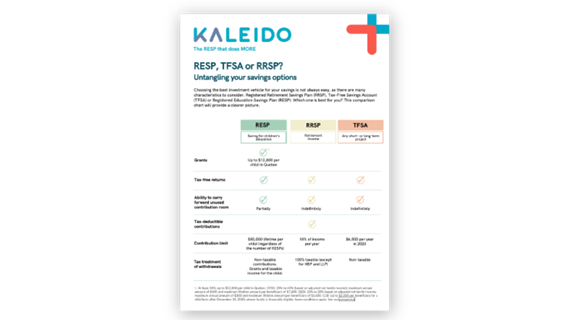

Need to take a quick look at the benefits and terms and conditions of each investment?

See our checklist on RESPs, RRSPs and TFSAs.

It all depends on your income and your priorities. But we offer you two smart strategies for taking advantage of both RRSPs and RESPs.

STRATEGY 1 – Make the same investment pay off twice by starting with the RESP

For most families, post-secondary education is a huge investment that shouldn’t be taken lightly. Fortunately, with an RESP, every dollar invested, up to a maximum of $2,500 per year, earns you a minimum of 30% in government grants.1 So it may be a good strategy to devote a larger portion of your budget to the RESP when your children are young, in order to prioritize the financial challenge you will face first (your children’s education) and take full advantage of government grants.

Later, when your child begins their post-secondary studies, they will be able to recuperate the grants and the income accumulated on them.6 This could be your chance to work some magic! You’ll get back your tax-free contributions,7 which you can reinvest in your retirement savings by catching up on unused RRSP contribution room from previous years.

It’s a wise strategy for making the same initial investment pay off twice, by taking advantage of two government incentives!

STRATEGY 2 – Deduct RRSP contributions from your income and reinvest them in the RESP

If your priority is retirement savings, but you don’t want to neglect your child’s education, we have a solution that lets you take advantage of both tools: generate a tax refund through your RRSP, which you can then reinvest in your child’s RESP to receive at least 30% in government grants.

It’s a well-known fact: by contributing to your RRSP, you reduce your annual income, which in turn reduces the amount of income tax you pay.

To help you determine your tax-free RRSP contribution strategy, here are the tax rates by income bracket5:

Federal

|

Taxable income |

Tax rate |

| $57,375 or less | 15% |

| Over $57,375, but not more than $114,750 | 20.5% |

| Over $114,750, but not more than $177,882 | 26% |

| Over $177,882, but not more than $253,414 | 29% |

| Over $253,414 | 33% |

Provincial

|

Taxable income |

Tax rate |

| $53,255 or less | 14% |

| Over $53,255 , but not more than $106,495 | 19% |

| Over $106,495, but not more than $129,590 | 24% |

| Over $129,590 | 25.75% |

No matter which savings strategy you choose, you’ll be able to save regularly for both your projects, without putting all your eggs in one basket!

Contact us to discuss it!

Why should I maximize my RESP?

What does it mean to maximize a Registered Education Savings Plan?

It’s simply a matter of contributing as much as you can each year, in order to receive the maximum grants possible. Taking advantage of these grants allows you to make the most of your investment and ensure maximum EAPs (Education Assistance Payments) for your child.

When your child begins their post-secondary studies, you can apply for an EAP to withdraw grants and accumulated income from your RESP.6 As for the capital (your contributions), it can remain in the Registered Education Savings Plan and continue to grow tax-free until disbursed, or you can transfer it to an RRSP or RESP for your other children,8 depending on the disbursement strategy you choose.

Contact us for more information on RESPs and their benefits!

1. Canada Education Savings Grant (CESG) from 20% to 40% and Quebec Education Savings Incentive (QESI) from 10% to 20%. Based on adjusted family net income. The maximum annual CESG payment is $600 and the maximum annual QESI payment is $300. The lifetime maximum per beneficiary is $7,200 for CESGs and $3,600 for QESIs. Canada Learning Bond (CLB) of up to $2,000 per beneficiary for a child born after December 31, 2003, whose family is financially eligible. Certain conditions apply. See our prospectus at kaleido.ca.

2. Basic Canada Education Savings Grant (CESG) of 20% and basic Quebec Education Savings Incentive (QESI) of 10%. The maximum annual amount paid under the basic CESG is $500 ($1,000 if there is unused entitlement from a previous year) and $250 under the basic QESI ($500 if there is unused entitlement from a previous year). Additional CESG of 10–20% and Additional QESI of 5–10%, based on adjusted family net income. The cumulative lifetime maximum per beneficiary is $7,200 for CESGs and $3,600 for QESIs. Certain conditions apply. See our prospectus at kaleido.ca.

3. Certain conditions apply. See which post-secondary programs are eligible at https://www.canada.ca/en/employment-social-development/programs/designated-schools.html.

4. Subject to obtaining the necessary authorizations to proceed with grant applications. Certain conditions apply. See our prospectus at kaleido.ca.

5. These amounts are adjusted for inflation and other factors for each taxation year. Sources: Federal government: "Tax brackets and rates."; provincial government: "Taxable income".

6. See which post-secondary programs are eligible at https://www.canada.ca/en/employment-social-development/programs/designated-schools.html. Certain conditions apply. Maximum withdrawal allowed under the Income Tax Act.

7. Savings invested in Treasury bills, government bonds and quality companies. Refunds of contributions are subject to investment risks. Certain conditions apply. See our prospectus at kaleido.ca.

8. Certain conditions apply. See our prospectus at kaleido.ca.