Stepfamily: A New Way to Manage Finances?

Written by: Catherine Levesque

Merging the finances of two separate nuclear families, just like splitting finances after a separation (with or without children), often comes with its share of challenges! There’s a plethora of factors to take into consideration and multiple possibilities. Without giving you the ultimate solution, here are some points to reflect on and that can guide you in building a new healthy and functional financial environment within your stepfamily.

Coming Up With an Optimal Joint Financial Strategy

At the beginning of a relationship, it’s legitimate to want to prolong the excitement of the “honeymoon phase” and not want to address topics that might provoke arguments, especially when those topics involve finances and the management of children budget-wise. However, delaying that discussion only makes it more complicated.

Here are a few points to address when the time comes, acting as a foundation to build your new family financial structure:

- Your financial habits: Compare your habits; everyone has a different relationship with money.

- Your budget: Take stock of your current finances and financial projections, then make a joint budget.

- Respective responsibilities: Determine your roles to know exactly how you want to assume your family’s financial obligations together.

- The children’s financial needs: Specify the expectations and wishes for each child.

- The financial impact: Forming a couple within the meaning of tax law impacts tax credits and child benefits. Evaluate the impact for your situation as a stepfamily and get the help of a professional if needed. It’s also a good time to address the question of your kids’ RESPs.

- Financial ties to your ex-partner: Define these and, if needed, set limits.

There are no wrong or right ways of doing things, only priorities and related values to clarify with your new partner. Once you address that, you’ll be ready to start implementing your joint financial strategy.

Implementing Your Joint Financial Action Plan

There are possibly as many solutions as there are stepfamilies. But there are three main ways of doing things. Since a picture is worth a thousand words, you’ll find below illustrations explaining the ways to go about managing your finances as a new family. These simple diagrams will help you fully understand the cash flows and can even be used as a tool for raising your children’s financial awareness.

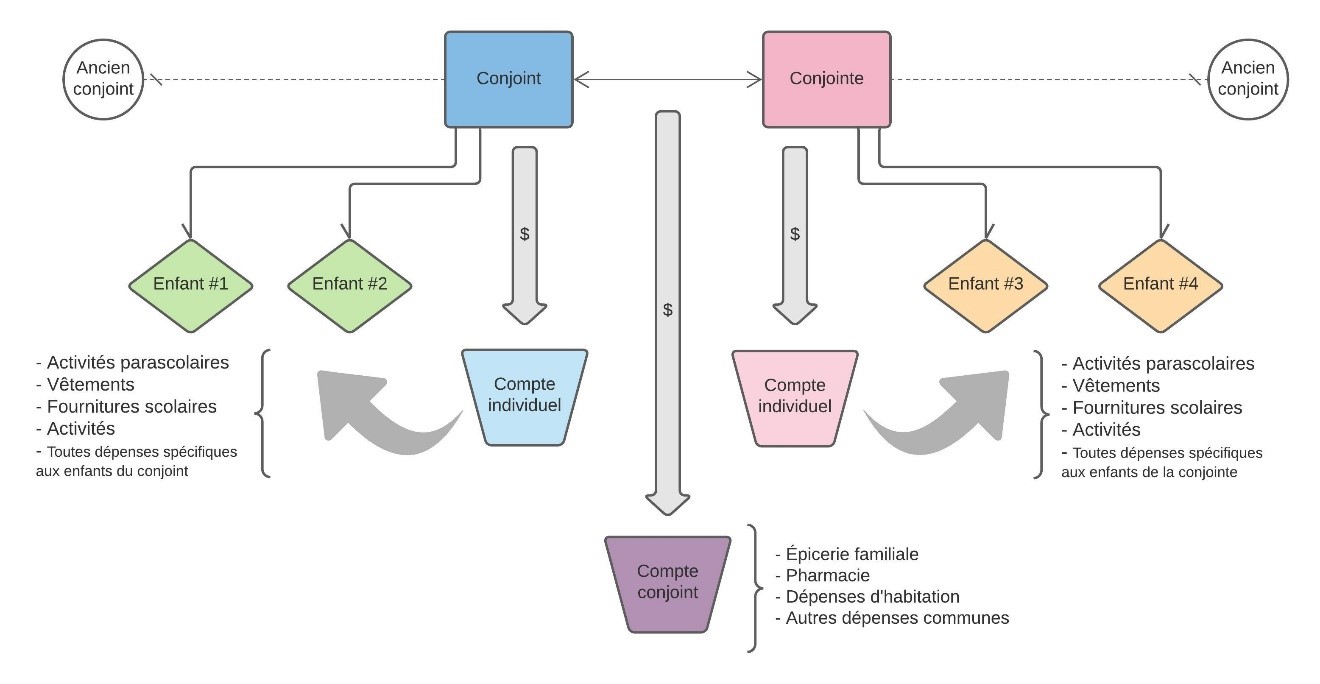

Model 1: Each Partner Assumes the Expenses for Their Children

This model provides the most autonomy and independence. Each adult assumes the expenses specific to their children. Housing expenses and other shared expenses are covered by your joint account. This way of organizing your finances ensures better management, as well as a better stability of the expenses for each child. It minimizes the involvement of your new partner in financial decisions regarding your kids and also spares you from having contacts with your ex, the parent of your children.

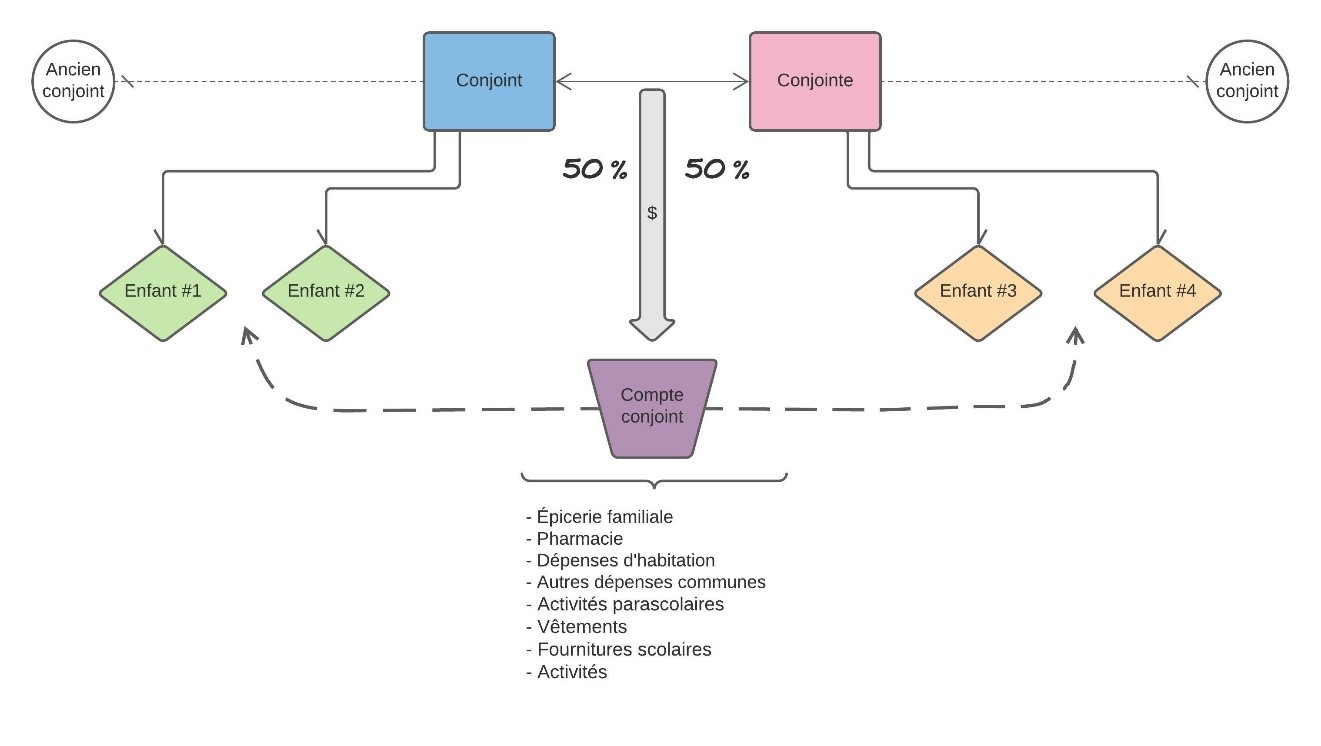

Model 2: Dividing the Family Budget Into Equal Parts

In this model, all expenses are assumed together. No distinction is made between the expenses related to each partner, the children, and the family. This is a very inclusive financial approach; everyone is equal. This model is the simplest one, if you respect certain criteria to avoid conflicts. The relationships within the new family, as well as with the exes, must be friendly. Plus, the new partners must have similar incomes, values and spending habits.

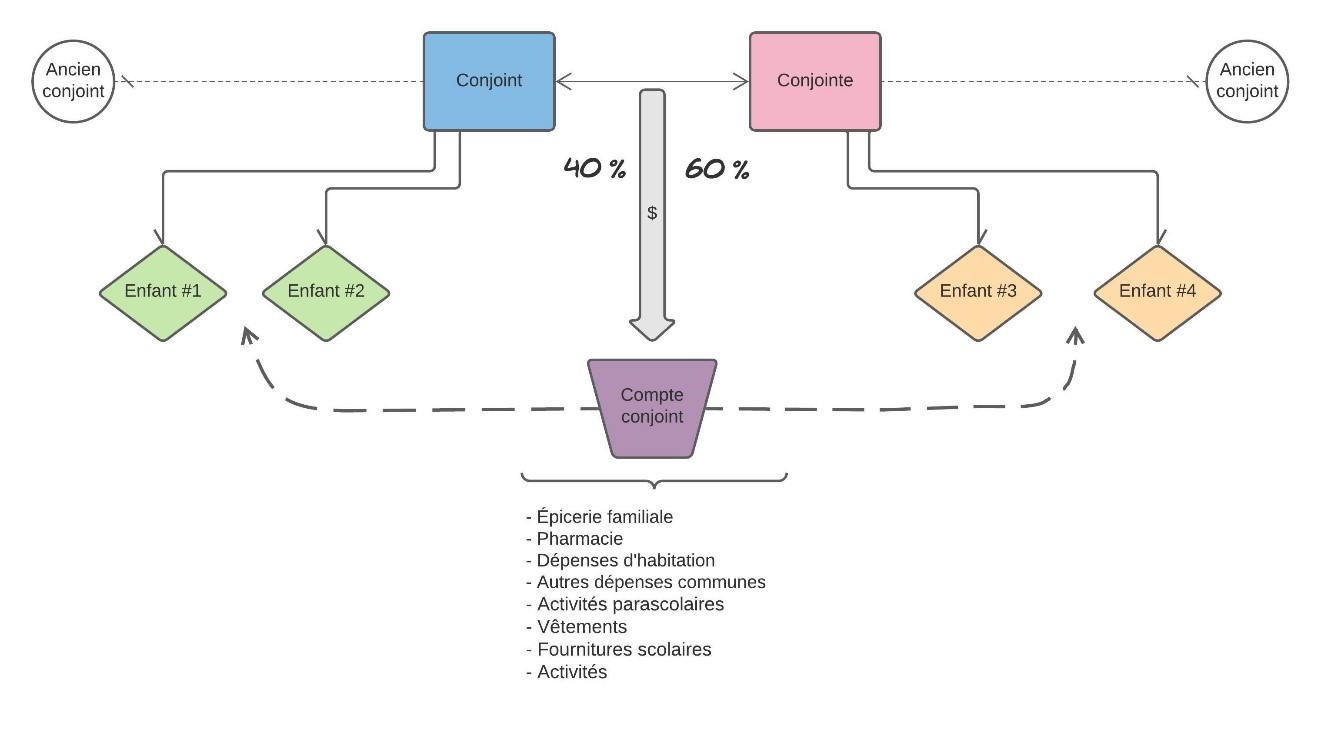

Model 3: Each Partner Contributes to the Family Budget in Proportion to Their Income

This model is a variation of model 2. Each partner contributes to the joint account based on their income. This strategy aims to be fairer to each partner. However, it requires a more in-depth analysis and can create tensions in your relationship.

Harmonizing Your New Family Situation Beyond Finances

Establishing the financial identity of a new stepfamily goes beyond numbers. Two identities with different values come together to form a new one. From this process come important factors to take into account:

- Communication/honesty: The cornerstone of this entire process.

- Equity and equality: Two opposing fundamental principles; make sure to establish which one you subscribe to.

- Estate: A new partner entering your life may change your wishes regarding your estate, but also create certain problems in the event of your death.

- Insurance: Your needs may change considering your new reality; coverage and beneficiaries should also be reviewed.

- Retirement: This is a long-term plan, but you should evaluate whether you want to combine your efforts toward retirement.

- Written agreement between common-law partners:when a couple isn’t married, this important document dictates the rights and obligations of each person.

In conclusion, there’s no universal answer when it comes to the financial strategy of stepfamilies. You’ll have to create your own model. Furthermore, don’t look at financial matters with blinkers on, but with a global vision, which leads to the evolution of the family identity as a whole. Of course, addressing these matters can be unpleasant, but it’s a necessary evil. Communication is the key to everyone feeling comfortable in their new situation.

Interesting resource:

- Lucidchart is a free website that allows you to graphically recreate the cash flows of the different models. A simple and useful tool to help you manage your family finances.